alaska sales tax on services

State Substitute Form W-9 - Requesting Taxpayer ID Info. Sales taxes can also be referred to as retail excise or privilege taxes depending on the state.

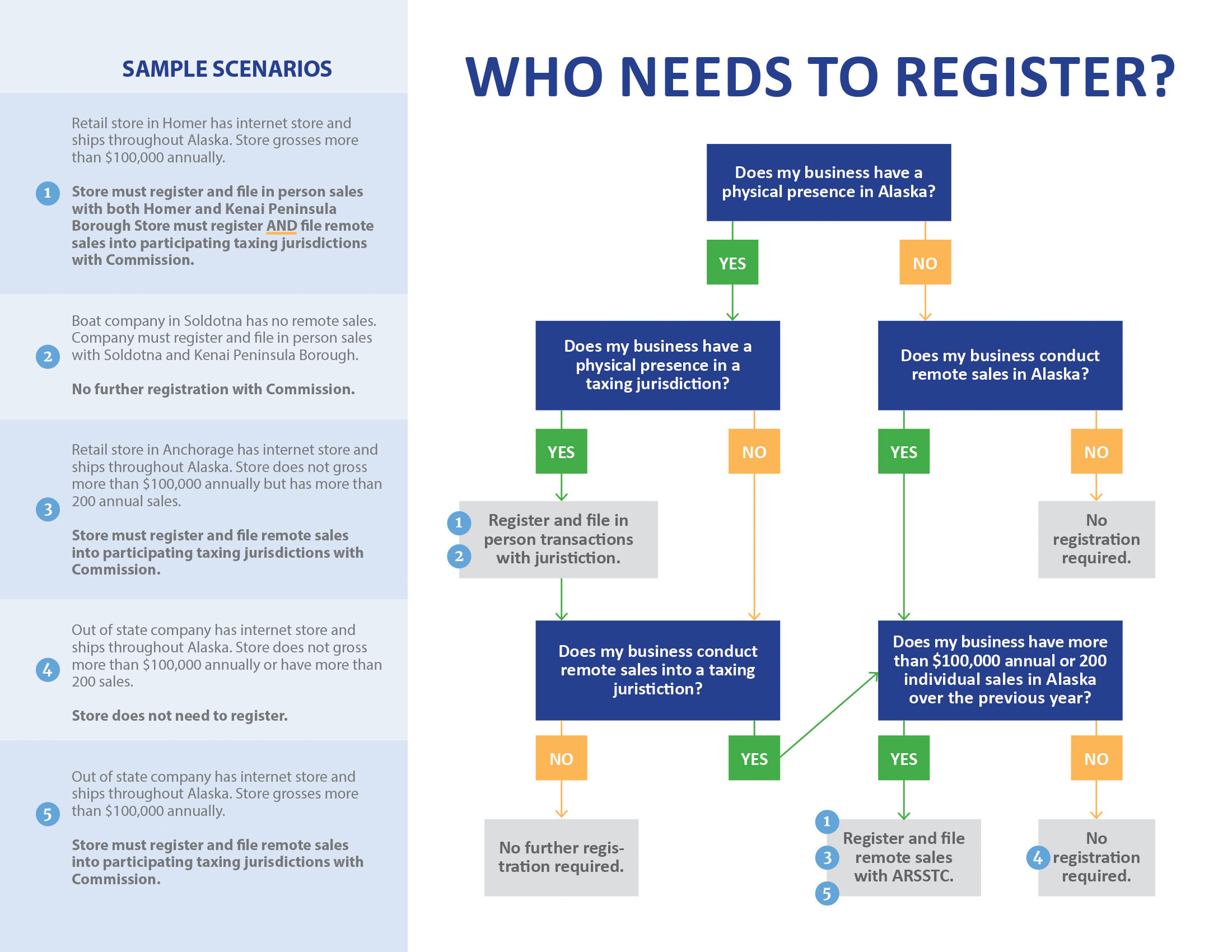

Alaska Remote Sellers Sales Tax Commission Arsstc

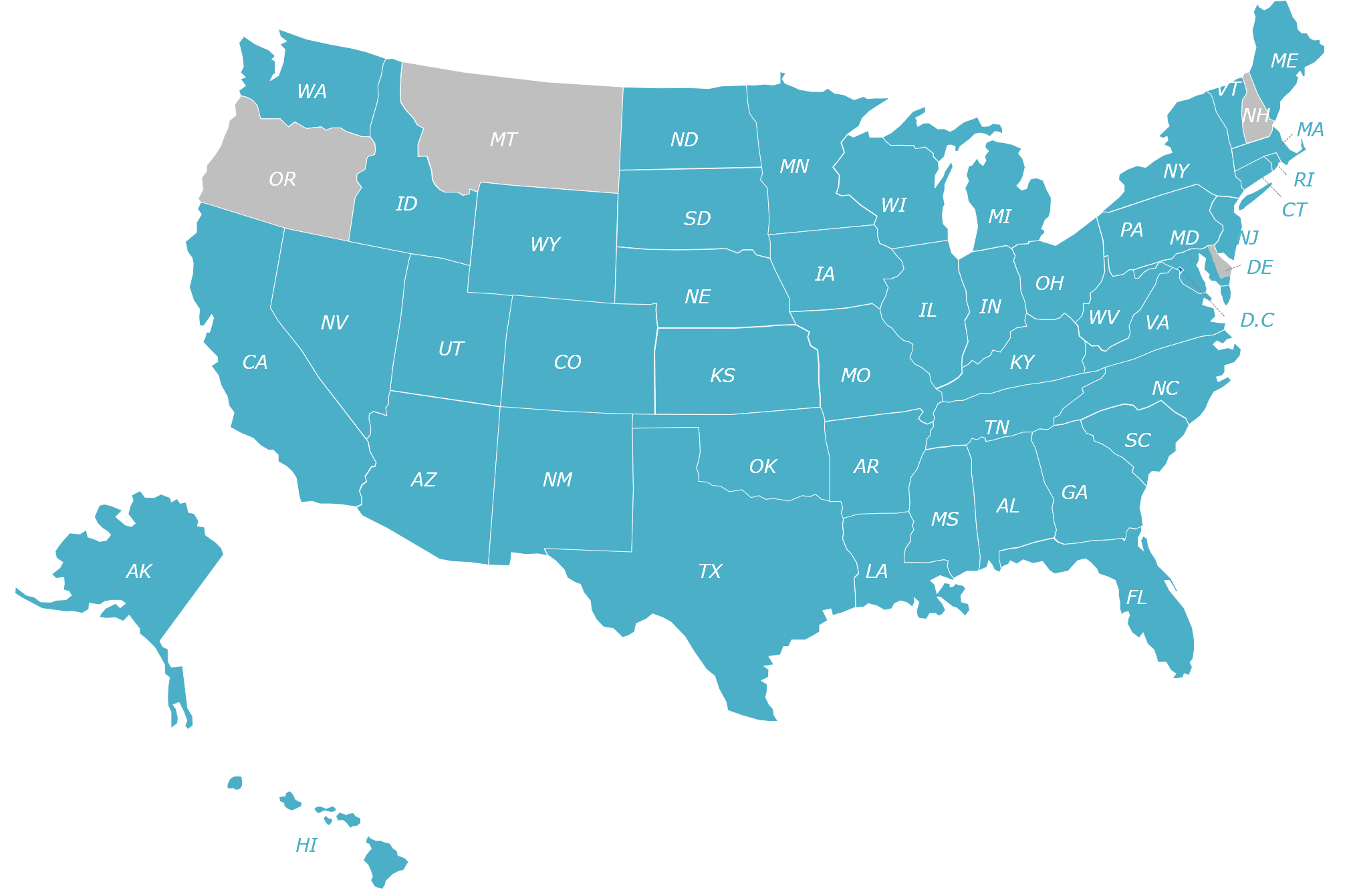

States have a statewide sales tax which is collected on most consumer purchases made within state borders.

. Note the following information. If the return was not filed in a timely manner a 25 late fee plus. Sales taxes are generally collected on all sales of tangible goods and sometimes services completed within the state although several states have started moving toward levying sales taxes on residents who make purchases online as well.

District of Columbia State of Alaska Sales Tax Exemption PDF Tax Information. Sales tax is paid by the buyer and is collected by the seller. State of Alaska Department Administration Division of Finance.

The taxability of various transactions like services and shipping can vary from state to state as do policies on subjects such as whether excise taxes or installation fees included in the purchase price are also subject sales tax. Of these Alaska allows localities to charge local sales taxes. The sales tax return and the related remittance of sales tax is due and must be received not merely postmarked by the City not later than 5 pm on the last business day of the month immediately following the month quarter or semi-annual period for which the return was prepared.

Must pay sales tax in the state of Arizona. A sales tax is levied on retail sales of goods and services and ideally should apply to all final consumption with few exemptions. Must pay sales tax in the state of Arkansas.

Must pay sales tax in the state of Alabama. Labor and services such as car repair landscaping janitorial services and more are subject to sales tax on the labor charges as well as the materials consumed. All but five US.

Sales tax is a tax that is paid to a tax authority for the sale of goods and services. The full list of taxable services includes. There is no sales tax in the state of Alaska.

Must pay sales tax in the state of California. States other than Alaska Delaware Montana New Hampshire and Oregon collect statewide sales taxes. The sales tax is 5 in Juneau while Anchorage and Fairbanks do not have sales.

As of 2020 local. Present the Ohio Sales Tax Exemption form to claim sales tax exemption. The seller has the obligation to remit the tax to the proper tax agency within a prescribed period.

While there is no imposed state sales tax in Alaska local governments can levy taxes on certain goods and services. And travel services for State government. State Office Building 333.

Alaska Remote Sellers Sales Tax Commission Arsstc

Alaska Tax Rates Rankings Alaska State Taxes Tax Foundation

Amazon Tax Vs Existing State Use Taxes American History Timeline Accounting Services Tax

Nomad States The Latest On Sales Tax

Alaska State Taxes 2021 2022 Income And Sales Tax Rates Bankrate

404 Not Found Tax Services Sales Tax Junior High Math

Where Amazon Collects Sales Tax Map Excel Grid

How Much Does Your State Collect In Sales Taxes Per Capita Tax Sales Tax District Of Columbia

State And Local Sales Tax Rates Sales Taxes Tax Foundation

Erpnext Support Services Supportive Business Continuity Support Services

U S States With No Sales Tax Taxjar

.png)

States Sales Taxes On Software Tax Foundation

Why Hb 1628 S Sales Tax On Services Is Bad For Maryland Maryland Association Of Cpas Macpa

Accounting And Tax Services Flyer In 2022 Tax Services Bookkeeping Services Accounting Services

Pennsylvania Sales Tax Small Business Guide Truic

Alaska Sales Tax Guide And Calculator 2022 Taxjar

State And Local Sales Tax Rates Sales Taxes Tax Foundation

2022 Sales Tax Rates State Local Sales Tax By State Tax Foundation